- cost of assets used in a business such as plant and machinery office equipment furniture and fittings motor vehicles etc. Its meant to cover the costs of using your own car.

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Energy efficient equipment including electric and alternative fuel vehicles.

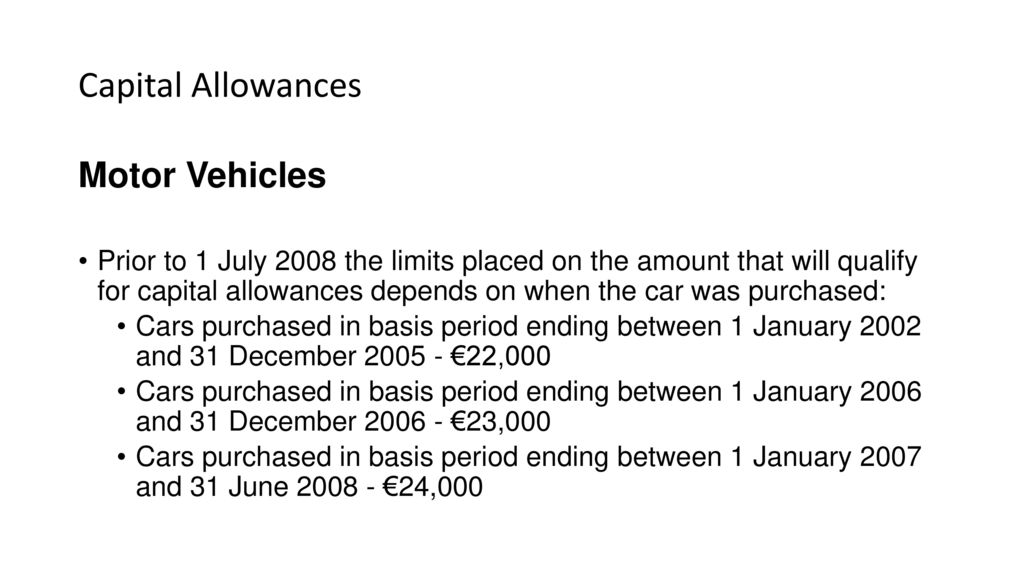

. Passenger vehicles include. RM50000 RM100000 applies only to new vehicle with total cost not exceeding RM150000 purchased on or after 28 Oct. The type of vehicle you have and the time of year in which you bought it are both factors in determining how much capital cost allowance you can claim.

A car allowance is what an employer gives employees for the business use of their personal vehicle. 27 August 2015 _____ Page 4 of 22 52 Vehicle a QE for a vehicle licensed for commercial transportation of goods or passengers is the cash price of the vehicle including basic accessories1 and registration fee which is required by the Road. The time the property is delivered or is made available to the claimant and is capable of producing a saleable product or service.

Capital cost is the amount on which you first claim CCA. Example You buy a laptop and use it outside your business for half of the time. The Massachusetts Registry of Motor Vehicles RMV is reminding customers of the federal requirement that anyone traveling by plane domestically or wishing to enter certain federal buildings will need acceptable identification credentials effective May.

Qualifying expenditure QE QE includes. 5042022 Massachusetts Registry of Motor Vehicles. Rates and Fees Refunds TCC TRN FATCA GCT on Government Purchases Direct Banking Direct Funds Transfer.

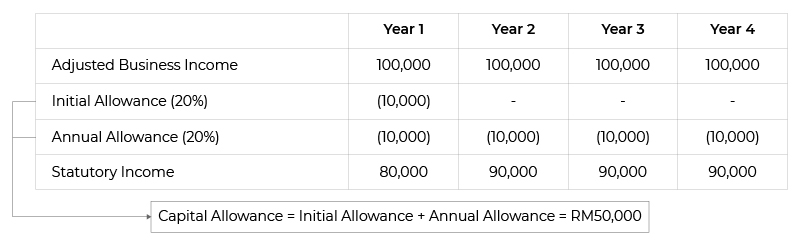

The annual allowances for private motor vehicles is to be computed on the deemed cost of 3200. Reduce the amount of capital allowances you can claim by the amount you use the asset outside your business. Capital Allowance of Motor Vehicle.

The annual allowance for motor vehicles other than taxis and short term hire vehicles see below is 125 on a straight line basis subject to a maximum qualifying cost of 24000 for motor vehicles. Under the Capital Allowances Act 2001 section 38B the cost of a car is not eligible for the AIA. Capital Cost Allowance for Motor Vehicles.

B6 CAPITAL ALLOWANCES A1. Capital allowance is only applicable to business activity and not for individual. Motor vehicles include pick-up trucks trucks or vans used to transport goods or passengers usually having a minimum use of 50 business use sometimes even 90.

However the maximum capital allowance that a taxpayer can. The purpose of capital allowance is to give a relief for wear and tear of fixed assets for business. No initial allowance is granted.

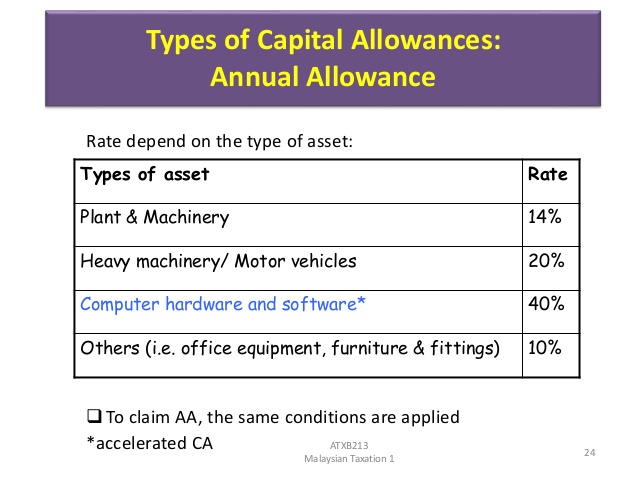

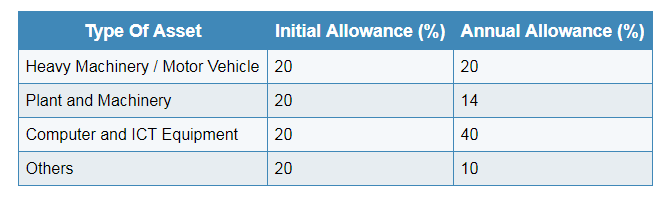

Generally the capital cost of the property is what you pay for it. The rate for Initial Allowance and Annual Allowance is 20 respectively. Asset Initial Allowance Annual Allowance Machinery Plants 20 7½ Motor Cycles 12½ 12½ Motor Vehicles trade 12½ 12½ Private Cars 0 12½ Scales 20 10 Spraying Machines gas other 20 20 20.

A car allowance covers things like fuel wear-and-tear tires and more. The availability of capital allowances will depend on. Until 31st March 2020 provided that the governments.

Get The Facts On Capital Allowance. Some examples of assets that are normally used in business are motor vehicles machines office. A vehicle of a construction primarily suited for the conveyance of goods or burden.

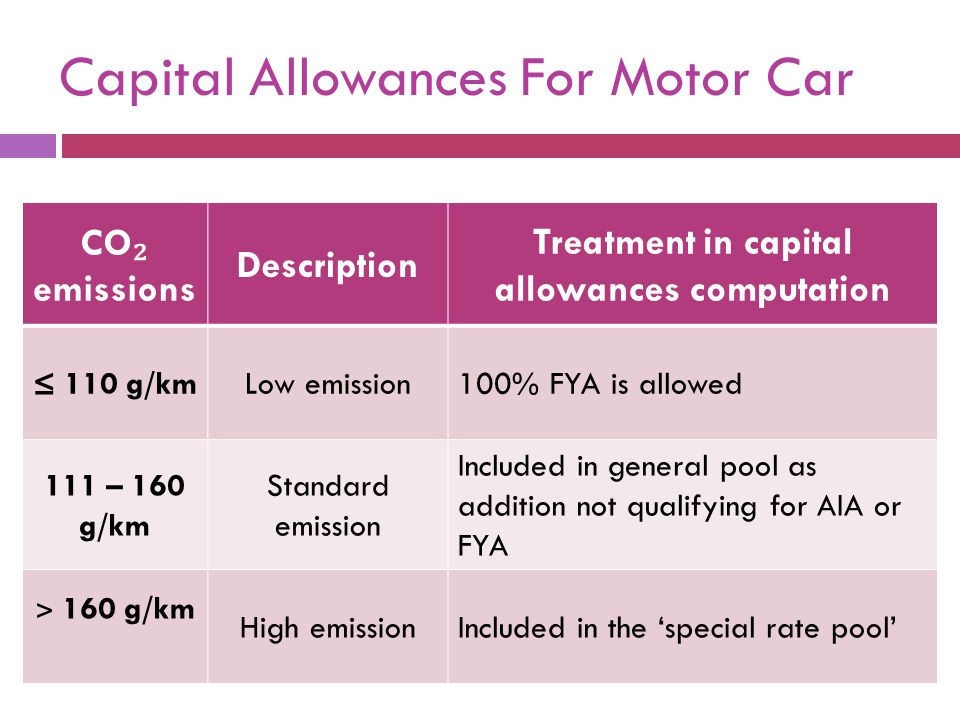

Capital cost also includes items such as delivery charges the GST and provincial sales. 4 over 25 years for most industrial buildings. However if the business is purchasing a car for business use it can utilise the WDA for deducting a portion of the cars value from the companys gross profits.

Capital allowance can reduce the assessable profits before arriving at the taxable profits. Capital Allowance - Rates A Before Janauary 01 2014 B As of January 01 2014. Motor vehicle will be classified into 2 categories-Commercial car such as van lorry and bus.

Capital allowances can be claimed on the costs of other motor vehicles such as vans lorries and motor cycles acquired for business use as well as on capital expenditure incurred on a foreign registered car used exclusively outside Singapore for business purposes under Section 19 or 19A of the Income Tax Act 1947. Qualifying expenditure on private motor vehicles restricted to. Capital expenditure incurred on a car registered outside Singapore and used exclusively outside Singapore for business purposes will be granted capital allowance.

Rules around Capital Allowances and cars. Noah works for Traveling Nurses Industries. Equipment in a creche or gym provided by the company to its employees.

If the motor vehicle qualifies for capital allowance the cost of obtaining the COE may be included when claiming capital allowance on the motor vehicle. COMPUTATION OF CAPITAL ALLOWANCES Public Ruling No. See all news and announcements.

Vans trucks and lorries are generally considered main pool assets for capital allowance purposes and therefore a Writing Down Allowance WDA of 18 can be applied. Motor Vehicle Drivers Lic. Costs of other motor vehicles such as vans lorries and motorcycles acquired for business use would qualify for capital allowances under Section 19 or 19A of the Income Tax Act.

A vehicle of a type not commonly used. Standard rates With effect from YA 2000 cyb capital allowances are re-categorised into three classes and the rates of. Using the drop-down arrow next to the line pertaining to Class to select the applicable class 10 or 101.

SOLVED by Intuit Intuit ProFile Tax Updated 1 week ago. Capital Allowance - Tourism Sector. 62015 Date Of Publication.

YA 2021 plant is defined to mean an apparatus used by a person for carrying on his business but does not include a building an intangible asset or any asset used and functions as a place. A car allowance is a set amount over a given time. For capital allowances purposes a car is a mechanically propelled road vehicle that is not.

Enter the CCA information for vehicles used for self-employment in Chart C of the Business Auto form BusAuto. Gas vehicles and refuelling equipment. In addition the amount paid by a registered owner of an existing vehicle upon renewal of the COE to enable the continued operation of the vehicle will be regarded as an additional cost of the.

You can claim Annual Investment Allowance AIA on the latter vehicles listed above because they are not considered cars. Claim capital allowances so your business pays less tax when you buy assets - equipment fixtures business cars plant and machinery annual investment allowance first year allowances. A company can claim an Accelerated Capital Allowance ACA of 100 for the following.

Entering The Capital Allowance Details

Introduction Capital Allowances Depreciation Specifically Disallowed Ppt Download

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Ms 3255 Business Taxation Capital Allowances Plant And Machinery Ppt Video Online Download

Introduction Capital Allowances Depreciation Specifically Disallowed Ppt Download

Tax Planning For Business Assets The Star

Preparing The Capital Allowance Computation Acca Taxation Tx Uk Youtube

Capital Allowance Liberal Dictionary

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

F6 P6 Capital Allowances Youtube

Chapter 7 Capital Allowances Students

Capital Allowances By Associate Professor Dr Gholamreza Zandi Ppt Download

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

Capital Allowances By Associate Professor Dr Gholamreza Zandi Ppt Download

What Is Capital Allowance And Industrial Building Allowance How To Claim Them Anc Group

Notes Capital Allowance Capital Allowance Capital Allowance Is A Tax Relief For A Business Who Studocu

Capital Allowance Calculation Malaysia With Examples Sql Account